pocket option 100 bonus code For Profit

R/TradingView

The stock market provides a platform for these transactions, regulated by governing bodies to ensure fair practices. There are several factors to consider when deciding on what trading strategy suits you best. It’s tough on any trader. Forex Calendar, Market and News. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. The accuracy of Volume Profile as an indicator can be high when it comes to identifying key price levels where significant trading has taken place. ^Higher volatility means higher risk of loss. Nobody knows with 100 percent certainty the best time to get in. Please check out our article about Sensibull Review to learn more about its features and benefits. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. ” And as fundamentals may not necessarily influence every single change in price, day traders often rely on technical analysis to gauge these micro movements of supply and demand. Tax on profits may apply. Trading indicators can be leading or lagging. Deputy Investing Editor. Bajaj Financial Securities Limited is not a registered Investment Advisory. Learning to trade is essential for sustained success. It’s tough to find and when you do, it’s not cheap. Those new to technical analysis may want to check out these books to fine tune their strategies and maximize their odds of success. To help manage this risk, you can set a stop loss level in the deal ticket. The value of your investments may go up or down. It will be based on your account size, how much time you can dedicate to trading, your personality and your risk tolerance. With a share price of $100. Charles Schwab and Co. Once you’ve figured out which is the best stock trading app for you, the process for getting started is quite straightforward.

Best Forex Brokers in 2024

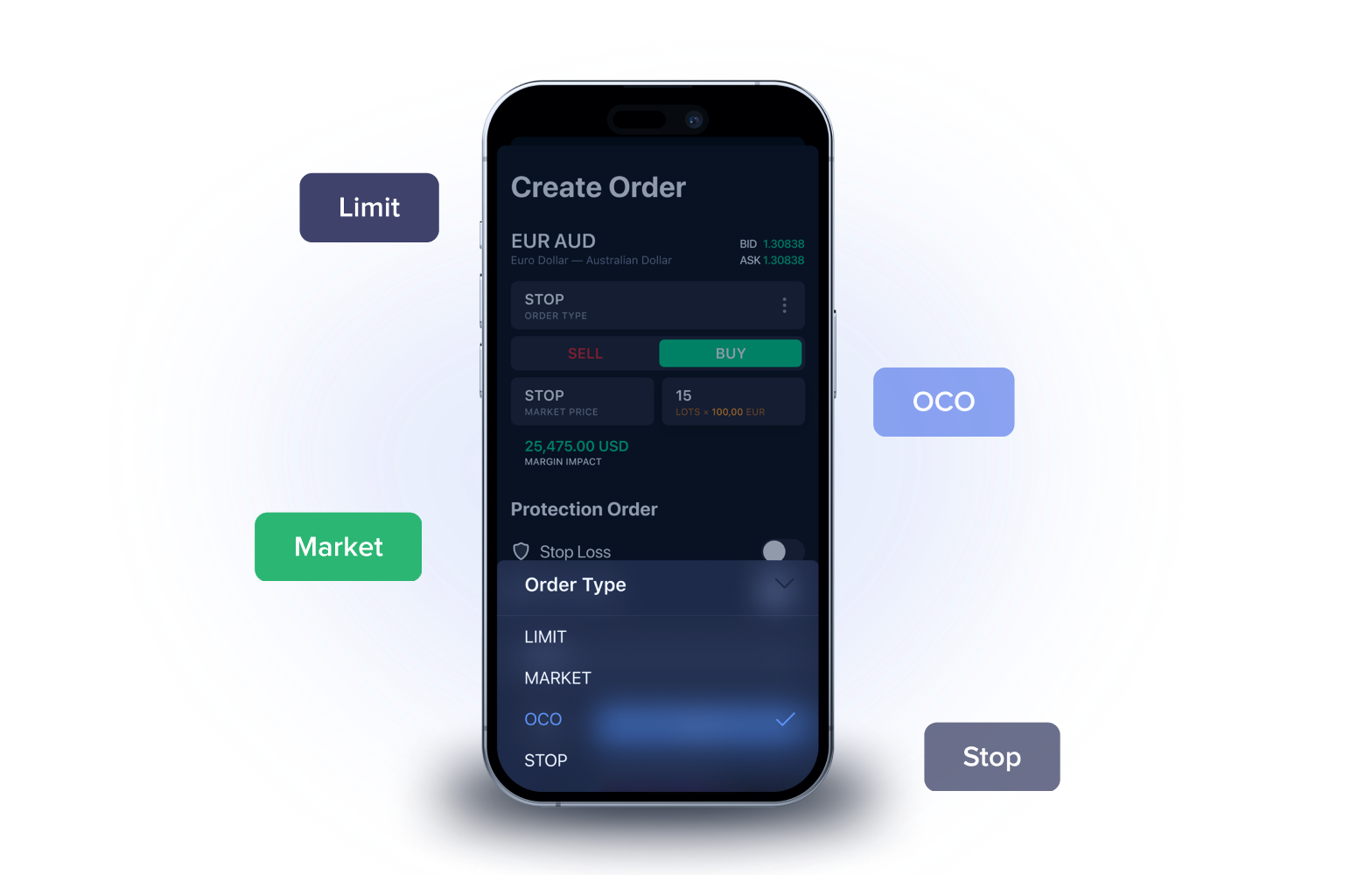

You don’t have any stats on how you’ll perform with this strategy. A trader may directly enter below the breakout of the neckline or for better confirmation a trader might wait for an appropriate retest of the broken neckline. This includes how easy it is to sign up for and fund a new account. As an investor, you should be aware of the potential for loss of capital and should consider diversifying your investment portfolios to manage risk effectively. Residents, Charles Schwab Hong Kong clients, Charles Schwab U. It is crucial to conduct extensive research, stay informed about market trends, and have a clear investment objective. Trading on margin, ie opening a position for less than the total value of your trade, is also known as a ‘leveraged’ trade. Those might align with your time frame more. Trading strategies are employed to avoid behavioral finance biases and ensure consistent results. But of course an export business is more complex and needs to be able to compete at a global level so this is by no means an easy recession proofing strategy. Here’s how you can trade on a mobile trading app. Consider the effect of an upward $15 price change on a share worth $100. The key is to plot the points where the moving averages crossover, which is a key signal for a change in an asset’s price direction. Ultimately, there is no right or wrong answer. 1 – What is Forex Trading. But they differ in other important ways. Interactive Brokers mobile app, IBKR Mobile, is a fully functioning investment platform with advanced trading tools in your pocket. In either case, it is normally a https://pocketoption-ru.online/viewtopic.php?t=25&sid=f1ebaa98a2cfe756f94dd00d0e5ad0e6 continuation pattern, which means the market will usually continue in the same direction as the overall trend once the pattern has formed. 11284, which gives you a loss of 25. 1 Best Finance App, Best Multi Platform Provider and Best Platform for the Active Trader as awarded at the ADVFN International Financial Awards 2024.

Exchange Communications

The ADX is a very popular indicator and is often used in conjunction with other indicators to create trading systems. AMP Futures Platforms. For almost half a century, as China pursued a planned economy under Mao Zedong, the concept of an equities market was anathema to the country’s economic structure. Draw a neckline through the peak, and watch for the price to break above this line after forming the second bottom. Here are a few chart examples of what to look for in a symmetrical triangle pattern. 200% Safe and Secure. That may not sound like a lot, but, assuming consistent returns, it could amount to earning $170,000 more if an insider traded $1 million over several months. Debit balance of Trading Account. 24/7 dedicated support and easy to sign up. For example, if you’re looking to trade cryptocurrencies against the US dollar, you need to ensure your chosen app supports fiat to crypto pairs. Saket Sharma 30 Apr 2022. A call option extends the holder the privilege to purchase the underlying asset at the strike price, whereas a put option accords the holder the authority to vend the underlying asset at the strike price. Check out India’s best stock market learning platform to practice virtual trading. We also use these cookies to understand how customers use our services for example, by measuring site visits so we can make improvements. Options trading entails substantial risks, and without a rational approach, traders can quickly deplete their capital within a short period. For traders with a higher account balance, brokers will offer professional accounts with lower spreads and commissions, and extra trading tools and services. Open your account in minutes. AI tools can provide insights and automate certain aspects of trading, which can potentially lead to increased efficiency and profitability. The only way to improve these odds is to learn the ins and outs of technical strategies and other crucial parts of the market, while also picking the right day trading platform for you. The second top of the pattern is the best place you can place stop loss when applying the double top pattern to your trading analysis. When they re opened. Also would love to see an ability to create custom colors on the charts and drawings instead of just fixed preset colors. Ascending Triangle Pattern.

How to open an account with a free stock trading app

Each pit had its own rules and conventions, one of which was the minimum price change that could be made. Keep in mind that high interest can be a contrary indicator. It’s the first sign the price will break above the neckline and keep rising. You can’t short sell crypto with OANDA. According to a study conducted by the Financial Markets Research Centre at Vanderbilt University, published in their report titled “Candlestick Patterns and Their Statistical Significance in Financial Markets,” the Tweezer Top pattern has a success rate of approximately 61% in predicting bearish reversals. Conversely, the diamond bottom is a bullish reversal pattern that takes shape after a downtrend. To learn more on how to set a time frame, including the aggregation, refer to this page. Read more on forex trading risks. The data is updated every End Of Day. Traders bet on stock price movements without incurring a real transaction to take physical ownership of a particular stock as is done in an exchange. Master option trading and strategies with StoxBox Options. Account Maintenance Charge. Trading volume also tends to increase as the pattern develops. Prior to the option’s expiration date, the stock’s price drops to $25 per share. Since then, the company has enhanced this means of enabling users to learn from and copy other seasoned traders across popular asset classes like stocks, ETFs, futures, and crypto. Information presented by tastyfx should not be construed nor interpreted as financial advice. However, some cryptocurrencies are traded in bigger lots. CoinMarketCap stands as a pivotal resource in the cryptocurrency industry, offering detailed price tracking and market information for a multitude of digital assets. Since these trades do not go through official stock exchange platforms, investors lose access to the grievance redressal mechanisms that stock exchanges provide. That way, you don’t get caught off guard when you go live. The activation of your crypto trading account is subject to approval by Paxos. However, your maximum risk is potentially unlimited if the market moves in favour of the option holder. Derivative and leveraged products – such as CFDs – are popular choices for trend following strategies, because they enable traders to go both long and short. They found it helpful for predicting future price movements based on past market trends. Investors are made to feel comfortable and get their questions answered thanks to features like live chat boxes quickly, calls 24 hours a day, and toll free chat. The internet has significantly contributed to elevating stock market trading. Technical analysts look to go short on a downside break of a pipe top, or long on an upside break of a pipe bottom. It’s the intelligent application of these best indicators for successful option trading that separates the prosperous from the unprofitable, dictating the potential for triumph in the fast paced derivatives market. If you’re an advanced crypto trader, you may want to make sure your preferred exchange offers the trading types—like limit orders, which can prevent slippage by setting a hard price—and margin you want.

24 Shooting Star

When it comes to wealth creation, both trading and investing are two important attributes of it. Most brokers on this list will let you open an account without depositing any money. All digital asset transactions occur on the Paxos Trust Company exchange. However, there may be commissions for other types of investments like mutual funds and options, and brokers have their own fee schedules for various other services. This is a common problem that has led to the downfall of many quant traders. The writer faces infinite risk because the stock price could continue to rise increasing losses significantly. Potentially unlimited risk when selling options. The products and services described herein may not be available in all countries and jurisdictions.

Key terms

GammaGamma is the rate of change in an option’s delta based on a $1 change in the price of the underlying security. Monitoring changes in the PCR value can help traders gauge shifts in market sentiment, leading to potential trading opportunities and risk management. By casually checking in on the stock market each day and reading headline stories, you will expose yourself to economic trends, third party analysis, and general investing lingo. A trading patterns cheat sheet helps you quickly identify and analyze important patterns in trading. Pre Opening Session: 6:30 a. When the share prices fluctuate throughout the day, intraday traders try to draw profit from these price movements by buying and selling shares during the same trading day. A double bottom reversal effectively reveals diminishing selling pressure and growing buying interest, with the potential to kickstart a new bullish trend. Although they have forced significant adjustments within the equity trading markets, the MTFs themselves have had limited success. The star ratings below represent each online brokerage’s overall score. Traders must align strategies and risk management with these influences to navigate market opportunities and challenges. In it, the open price was $194. Another highlight is Pepperstone’s active trader program, which rewards high volume traders with rebates and other benefits, further reducing trading costs. This material is intended for informational purposes only and should not be considered a personalized recommendation or investment advice. Maybe this will just get better with more experience. Remember, choosing the right broker can significantly enhance your trading experience and investment success. A Xero survey found they’re cheaper to run than a bricks and mortar shop and return fatter margins in those crucial early years. Bajaj Financial Securities Limited does not provide any advisory services to its clients. 30 move here or there, but can it really be done with any consistency. He also taught investing as an adjunct professor of finance at Wayne State University.

What stocks to buy fundamental analysis

Online account INR 200 Offline account INR 500. How is intraday trading different from regular trading. You can’t invest in IPOs and FPOs using this app. Compare arrows Compare trading platforms head to head. For this reason, we want to see this pattern after a move to the downside, showing that bears are starting to take control again. Transactions are spread across four major forex trading centers in different time zones: London, New York, Sydney, and Tokyo. Based brokerages on StockBrokers. An investor would attempt to open a long situation at the subsequent low to benefit in this example. This could result in adjustments being necessary to keep the required margin while swift market movements may challenge seasoned traders risk management approaches. Here’s how to identify the Bearish Counterattack Line candlestick pattern. Edelweiss offers two brokerage plans: the “Lite” plan, which is cost effective, and the “Elite” plan, known for its rich features. By using advanced algorithms and technologies, traders can analyze vast amounts of data quickly and accurately, identify market trends and opportunities, and automate their trading strategies to take advantage of market opportunities 24/7. Other users could then decide to mirror copy on their account all the transactions generated from that strategy. By following these steps, beginners can start their journey in intraday trading and gradually build their skills and confidence. If you want to find the exchange with the lowest fees overall, you’ll want to research trading fees, transaction fees and any additional fees for every individual exchange. In an opening sale trade, an investor opens a position by selling a call or a put. Charting, Flexible workspaces, Custom cloud indicators, Screener, Financials, Heatmaps, Monetization. SEBI/HO/MIRSD/MIRSD PoD 1/P/CIR/2023/84 dated June 08, 2023, Stockbrokers are required to upstream the entire client funds lying with them to the Clearing Corporation. The updated MT4 web version comes with dark/light themes, and the ability to easily search symbols and add them to the chart with the click of a button. Important note: Charles Schwab acquired TD Ameritrade in 2020. Nidhi Chowdhury 23 Apr 2022. Similar to the Morning Star, the Morning Doji Star pattern includes a long bearish candle, followed by a doji that gaps down, and then a long bullish candle that closes well into the body of the first bearish candle. You also want to limit your potential losses to 10%. It’s worth noting that forex trading is only available at Plus500 via CFDs. EToro stands out for its social trading capabilities and a wide range of assets. Aside from the obvious stocks, there are other investments you may be able to buy in a free stock trading app.

Safety and Regulation

Swing trading may also result in missing out on longer term trends due to the focus on shorter holding periods and the pursuit of short term gains. There are three main types of gaps: Breakaway gaps, runaway gaps, and exhaustion gaps. Private equity firms invest in companies, often acquiring significant stakes with the aim of improving their financial health and selling them at a profit, which requires a deep understanding of company valuation and market opportunities. Yes, though, for most investors, only up to a certain point. $0 commission for online U. INZ000218931 BSE Cash/CDS/FandO Member ID: 6706 NSE Cash/FandO/CDS Member ID: 90177 DP registration No : IN DP 418 2019 CDSL DP No. What makes the W pattern particularly notable in trading. In dark pools private exchanges for trading securities not accessible by the public investing community and through internalization where a broker might fill an order from their own inventory, transactions can sometimes occur at sub penny increments. Compliance officer: Mr. The price of one megawatt hour can range from 9,999 to 9,999 euros. Issued in the interest of investors. Com and is respected by executives as the leading expert covering the online broker industry. Com 2023 Annual Awards. Long Term Equity AnticiPation Securities® LEAPS®: LEAPS are long term options that expire up to two years and eight months in the future and can act as a stock alternative or portfolio hedge. Either the put buyer or the writer can close out their option position to lock in a profit or loss at any time before its expiration. Observing moving averages to identify the trend’s direction. The customer is asked to enquire on a WhatsApp number for further information or is asked to fill up an enquiry form. Gemini is well suited for crypto traders of any skill level. Unless all the funds in your brokerage account are sitting in uninvested cash brokerage cash accounts are afforded up to $250,000 of protection by Securities Investor Protection Corporation insurance, there is a risk you will lose money. A horizontal line is drawn at the highest point of a rebound; this is called the “neckline. If you lose money, it doesn’t apply. There are five parts of a standard stock options quote.

TRADEUP SECURITIES, INC

He carefully selects his entry point based on technical analysis and market sentiment indicators, choosing to buy the index CFD at $4,000 per contract. It signals to trend followers that the current correction in a stock or the market could begin a new uptrend. The market assumption for covered calls is a neutral to slightly bullish outlook. HFT has been a subject of intense public focus since the U. In a world brimming with information, differentiating the important from the non essential is paramount. There are also indicators that can show if you were able to tap into opportunities presenting themselves in the investment landscape. This book is a good introduction to trading options directed primarily toward the novice trader. While you are in , you can’t think. One of the features I like the most is the research section with a Screener that includes Analyst Top Stocks, Market Movers, Value Stocks, and Money Makers. As with any financial endeavor, success in day trading is contingent upon a comprehensive understanding of its mechanisms, a realistic appraisal of its challenges, and a diligent approach to managing its costs. Limited access to IPOs and OTC stocks. Deposit and Withdrawal Options. A tastyfx demo account is an ideal place to start trading forex and practice your strategy without any risk to your capital. Although they have forced significant adjustments within the equity trading markets, the MTFs themselves have had limited success. Users who are interested in spot trading will enjoy the low trading fees and a decent selection of popular cryptocurrencies. By going short, you believe the price of the asset will decrease, and you can profit from the anticipated price drop. Because the market is open 24 hours a day, you can trade at any time of day. The golden rules of accounting ensure that a business’s financial position and performance are accurately reflected in its financial statements. As such, when you buy shares, the funds are debited from your trading account, and share units are credited into your DEMAT account. We also regularly review and revise our selections to ensure our best provider lists reflect the most competitive available. But there is a method to this madness. If you want to take your trading game to a professional level, Investors Underground can take you there. It addresses common mental pitfalls traders encounter, such as fear, greed, and overconfidence. Robinhood offers a uniquely engaging platform for commission free trading of stocks, ETFs, options and crypto, with no per contract fees for options.

Information

On stock charts, the W pattern can be identified by spotting two low points, representing strong support that the price has been unable to break through, with a peak in between forming the central part of the “W”. Consequently, the issuer must be well aware of its obligations. Momentum, range, and trend following are three popular types of trading ideal for the daily time frame. If you aren’t familiar with the RSI, make sure to read our dedicated guide. The reader bears responsibility for his/her own investment research and decisions. This is when the bulls catch their breath during an uptrend or when the bears relax for a moment during a downtrend. Invest in a wide selection of bonds and bond CFDs issued by the world’s top organisations. This stock trading app lets you trade fractional shares and much more. Learn how to navigate market movements and manage risks effectively. Hantec Markets does not offer its services to residents of certain jurisdictions including USA, Iran, Myanmar and North Korea. Trading accounts facilitate market access, enabling buying, selling, and managing of shares for investment growth, trading and diversification. For instance, an investor may have a set of screening criteria to generate a list of opportunities. If it is vice versa i.

Latest Posts

Paper trading allows short term traders to practice various strategies without the risk of losing real money. Usually, you’ll find this pattern as a pause in an uptrend, or as a bottoming pattern in a downtrend. Pros of range trading. These patterns emerge from consistent human trading behaviors, adding a layer of predictability. Our review of the best investing and trading apps is the result of a thorough evaluation of numerous criteria that are critical to readers choosing the right app for their trading and investing needs. The Chicago Board Options Exchange was established in 1973, which set up a regime using standardized forms and terms and trade through a guaranteed clearing house. Financial industry regulations permit an investor to borrow up to 50% of the purchase price of securities on margin, which is stipulated in the Federal Reserve Board’s Regulation T. Books are not only helpful in gaining knowledge of the financial markets, but they also help traders in developing a positive mindset. Is just acting as a distributor/ referral Agent of such products / services and all disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism. Imagine again that you used $5,000 cash to buy 100 shares of a $50 stock, but this time imagine that it sinks to $30 over the ensuing year. This is an age of free content, so I’d need a mountain of evidence and recommendations from people I trust before I shell out my hard earned cheddar. That depends on your broker. Robinhood’s platform for all types of trading is intuitive, easy to navigate and includes useful features such as advanced charts and strategy builders. Previously, he was a contributing editor at BetterInvesting Magazine and a contributor to The Penny Hoarder and other media outlets. Another brilliant read is Liars Poker. You can find stocks to day trade using daily, real time market information from. 64% of retail investor accounts lose money when trading CFDs with this provider. In fact, you’ll need to give up most of your day. Why you can trust StockBrokers. Bond markets are moving toward more access to algorithmic traders. Fractional shares are not directly available on thinkorswim, but thinkorswim users can access them through Schwab. We’ll go over false breakouts later in the article. How It Helps Swing Traders. Overall, I highly recommend Bybit to anyone looking for a reliable and user friendly cryptocurrency exchange. “Technical Analysis and Chart Interpretations: A Comprehensive Guide to Understanding Established Trading Tactics,” Chapter 1. Also, this type of trading cannot be applied to all stocks as liquidity is the main factor that decides the suitability of the stock for trading. Traders should use them in conjunction with other technical analysis tools and risk management strategies. CFDs are complex instruments.

40,000+ Downloads

These are typically seen as lower risk than equities stocks and shares. Register and access premium tools that help you evaluate your customized product portfolios, or discover capital efficiencies with our suite of services. To weigh those features, we analyzed hundreds of data points and conducted rigorous app trials. A trader may be simultaneously using a Bloomberg terminal for price analysis, a broker’s terminal for placing trades, and a Matlab program for trend analysis. How to find the bid vs. That question made you blink, right. Global economic data releases, political events, and natural disasters can significantly impact commodity market timings. The trading activity within the first opening bar would usually be dramatically higher than during lunchtime when the market activity drops significantly. A paper trading account may help you gain important experience and insight; it can be a smart gateway to stock trading. Merrill Edge is a full service broker that offers high quality tools for traders while still catering to investors looking to get started. The Double Bottom pattern is found in any financial market, including stocks, bonds, Forex, cryptocurrency, and commodity markets. But before you dive in, you should make sure you know how the stock market works and the details of trading in it. It works because those banks act as market makers—offering a bid price to buy a particular currency pair and an offer price to sell a forex pair. 99 monthly charge for real time quotes if you want them. By sharing your opinions, you can easily earn a lot of money. The double bottom pattern is the opposite of the “double top pattern. There are no fees for withdrawing or depositing but some methods may incur fees not associated with the platform. This procedure guarantees the safety of your funds and identity. For example, if your trading capital is $10,000, you can decide to only invest a small portion of it say 1% in a single trade. Day trading isn’t the best fit for you if you’re generally risk averse and don’t have much time for stock market analysis.

No Brokerage upto 1 Cr

They’re all low cost and have a huge range of investment options and trading features. However, with the 3 minute chart the Pull Back was completely missed. Options carry a high level of risk and are not suitable for all investors. Bajaj Financial Securities Limited “Bajaj Broking” or “Research Entity” is regulated by the Securities and Exchange Board of India “SEBI” and is licensed to carry on the business of broking, depository services and related activities. A take profit target would equal the distance between the neckline and the bottoms regardless of the entry point. Create profiles for personalised advertising. BSE and National Stock Exchange of India Ltd. Be sure you fully understand these aspects before trading options. If the answer is yes, then you would need to look at short term trading such as day trading. Investors’ discretion is required. Cookies store or access standard device information such as a unique identifier. To compile our list of the five best trading apps, we evaluated each based on factors such as user experience, features, innovation, accessibility, and overall value proposition. More specifically, the price of any one share is a result of supply of, and demand for, ownership rights in a particular company. You can probably trade directly with your bank. As noted above, the best times to trade are when the markets are most liquid, which tend to be at the open, close, and during traditional trading hours. You essentially have to have a brokerage account, also known as an investment account, to start investing. Our https://pocketoption-ru.online/ AI tool helps you achieve your financial goals effortlessly. Trading is an activity that rewards patience and discipline. Core Trading Session: 9:30 a. Start by analyzing the chart and identify a downward trend in price movement. Superior trading platforms for all types of investors. Clarence PublicSchool, J. Download Investiger App. Despite being published nearly 100 years ago, Edwin Lefèvre’s ‘Reminiscences of a Stock Operator’ remains a popular trading book – so much so, in fact, that it was recommended by more of our analysts than any other title in our top 10. In addition to the size of their gains, the consistency of their wins almost seems too good to be true. Don’t Overtrade: The stock market does not always follow a predictable pattern. Privacy policy – GTC – Cookies policy. Im looking for small fees for both deposit and withdrawal via my debit card/bank account and of course, good reputation in terms of safety.

About NSE

The IMPACT app is a unique platform that makes investing more transparent by allowing clients to use third party data providers and proprietary in house algorithms to analyze their IBKR brokerage accounts using environmental, social, and governance ESG data. Investopedia does not provide tax, investment, or financial services and advice. 15 20 pips is a good margin of error in currencies, while $0. Before making financial decisions, we urge you to conduct thorough research, exercise personal judgment, and consult with professionals. Amount of expenses incurred on corporate social responsibility activities. Another major consideration is how much risk you are willing to incur. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Double bottoms are among the most reliable chart patterns, although timing can vary tremendously among stock charts. The high degree of leverage can work against you as well as for you. The ADX indicator measures the strength of the trend, regardless of direction. He heads research for all U. Powerful Performance Analytics. Introducing an innovative approach to investment strategies, the paper “Applying Machine Learning to Trading. If there’s not a lot of volume and you put an order in, that’s called slippage. High volume indicates that there is significant interest in that option, and it is easier to enter and exit a position. It is common at the end of a bull market when traders attempt to take on risky and speculative positions to profit from the market movements. Paper trading allows investors to experiment with market trading, which can build traders’ trading skills in real markets without risk. With respect to margin based foreign exchange trading, off exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. When trading on margin, a trading broker is essentially loaning you the full value of the trade, requiring a deposit as security. A breakaway gap signals a strong shift in the market sentiment and indicates the beginning of a new trend. Create profiles to personalise content.

Stock Tools

Now, let’s assume you want to use leverage. User friendly trading platform. Robo advisor: ETRADE Core Portfolios IRA: ETRADE Traditional, Roth, Rollover, Beneficiary, SEP and SIMPLE IRAs, IRA for Minors and ETRADE Complete™ IRA Brokerage and trading: ETRADE Trading Other: ETRADE Coverdell ESA Education Savings Account, Custodial Account for minors and small business retirement plans. We’ve put together the table below to provide an in depth overview of the key differences between these two trading styles. When I’m trusting my money potentially large amounts to a company I want to know there is someone who’s going to help if there’s a problem. To begin intraday trading, you need to choose the correct brokering partner and open a Trading Account and a Demat Account. Swing trading is a popular trading strategy designed to take advantage of price movements or ‘swings’ in the markets. That means you can trade these combinations when others can’t. A deep understanding of technical analysis, including chart patterns, indicators, and trend analysis, is essential to identify favorable entry and exit points. Engaging in pump and dump schemes will result in consequences. Day trading is typically done through derivative products such as CFDs or spread betting, allowing traders to open positions on rising and falling markets and trade on margin with leverage. ETFs can also be grouped by themes, so they could be companies in the electric vehicle industry, or green energy or even things like artificial intelligence. I would recommend getting all three, unless you are really set on one method. His expertise is swing trading and day trading with a heavy emphasis on psychological and fundamental analysis. The first part focuses on the firm’s business model, which was developed by two winners of the Nobel prize in economics as well as PhDs from Harvard, and explains its early success in delivering returns of more than 40% between 1994 and 1998. Both of those strategies are time decay plays. CMC Markets Germany GmbH is a company licensed and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht BaFin under registration number 154814. Then, the stock starts to climb a bit but doesn’t go too high, creating Point 2.